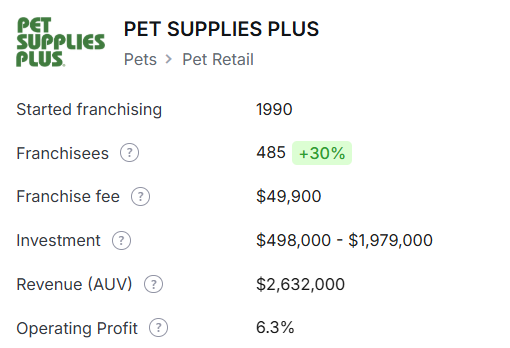

KEY FRANCHISE STATS

?

?

?

?

$0

Founded in 2007 by Veronica Gallardo, Veronica’s Insurance has become a prominent name in the insurance brokerage industry, particularly within the Hispanic community.

Based in San Bernardino, California, the company delivers an extensive portfolio of insurance products, covering auto, life, home, business, motorcycle, renters, and boat insurance.

The brand ventured into franchising in 2019, offering its proven business model to aspiring entrepreneurs who want to enter the insurance field. This strategic move has allowed the company to broaden its footprint while enabling franchisees to capitalize on a trusted name in the market.

What sets Veronica’s Insurance apart is its dedicated focus on serving the Hispanic population, one of the fastest-growing demographics in the U.S. By offering bilingual services in both English and Spanish, the company ensures that clients receive clear and personalized support tailored to their needs.

Create a free account to access this table and more.

For more information see our plans here.

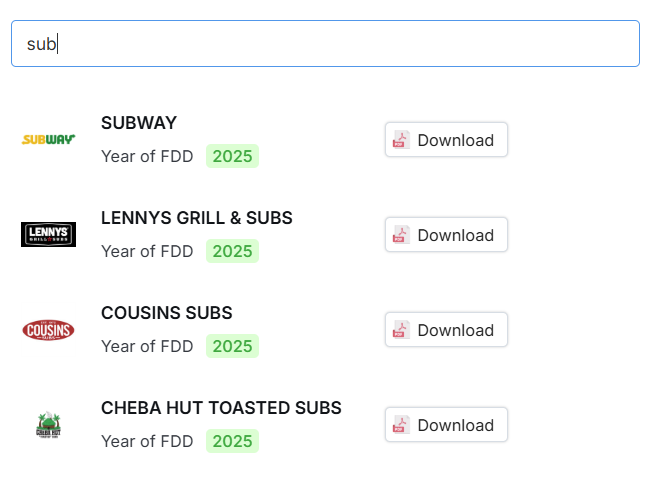

Below are some of

Veronica's

key competitors in the

Insurance

sector.

9

15% - 30%

$79,000

-

$140,000

$0

n.a.

$xxx,xxx

n.a.

n.a.

Veronica’s Insurance provides a comprehensive suite of training programs for its franchisees to ensure operational excellence. Here’s a breakdown of the training offerings:

Veronica’s Insurance grants franchisees a Designated Territory around their approved agency location, typically covering a radius of about four miles or defined by other boundaries. Within this area, the Franchisor agrees not to open or license another agency using the same brand.

However, the territory is not fully exclusive. The Franchisor reserves the right to operate or license competing businesses under different trademarks and to use alternative distribution channels, meaning franchisees may still face indirect competition even within their territory.

?

?

?

?

?

?

?

?

?

?